georgia property tax exemption codes

In Georgia property is required to be. Individuals 65 Years of Age and Older.

Homestead Other Tax Exemptions

Items of personal property used in the home if not held for sale rental or other commercial use.

. The taxes are replaced by a one. Disabled Person - 50 School Tax Exemption coded L5 or 100 School Tax Exemption coded L6 If you are 100 disabled you may qualify for a reduction in school taxes. People who are 65 or older can get a 4000 exemption.

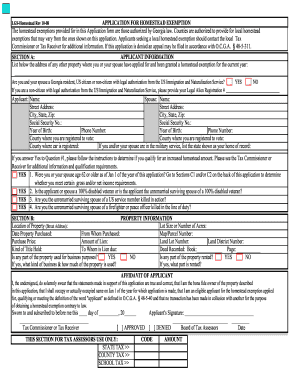

State and federal government websites often end in gov. The homestead freeze is the exemption equal to any increase of assessed value above the assessed value on the date the homestead exemption was approved. Apply for a Homestead Exemption.

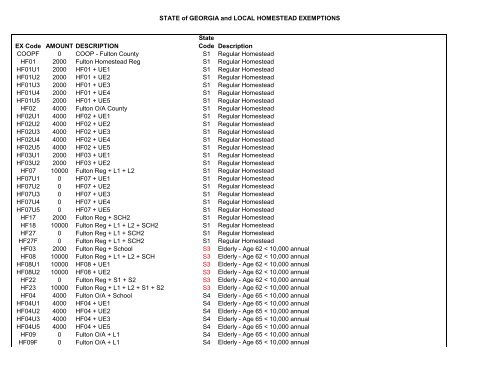

While the state sets a minimal property tax rate each county and municipality sets its own rate. STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX Code AMOUNT DESCRIPTION State Code Description COOPF 0 COOP - Fulton County S1 Regular Homestead. 2017 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-40.

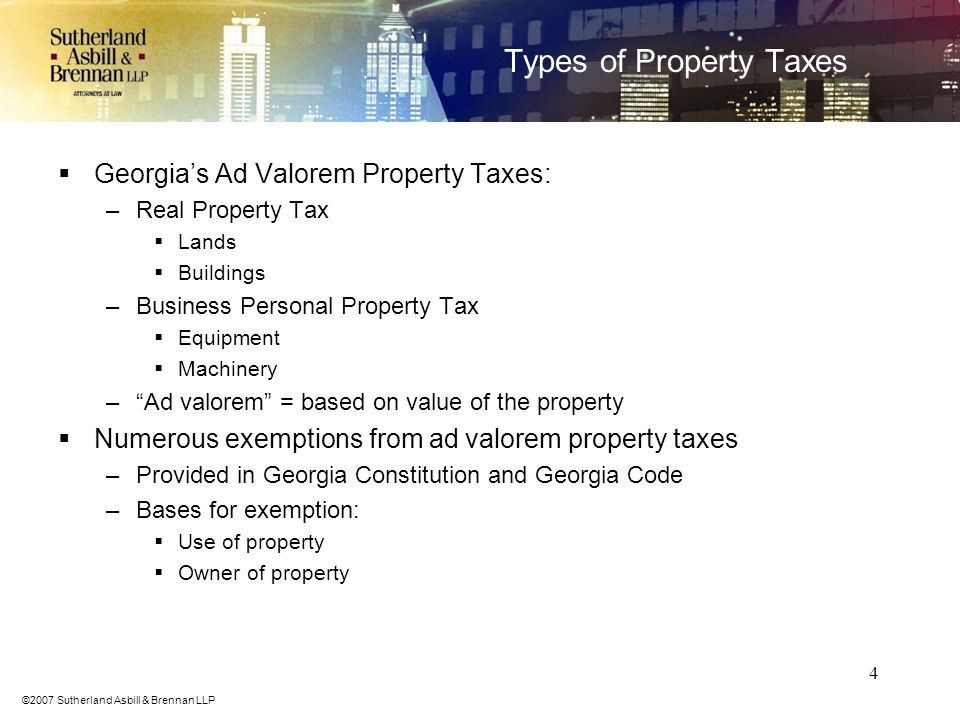

Theyre a funding anchor for public services in support of cities schools and special districts including sewage treatment. The Tax Digest Consolidated Summary herein referred to as consolidation sheets depicts the assessed totals of all property listed on a Georgia countys tax digest separated by tax district. State of Georgia government.

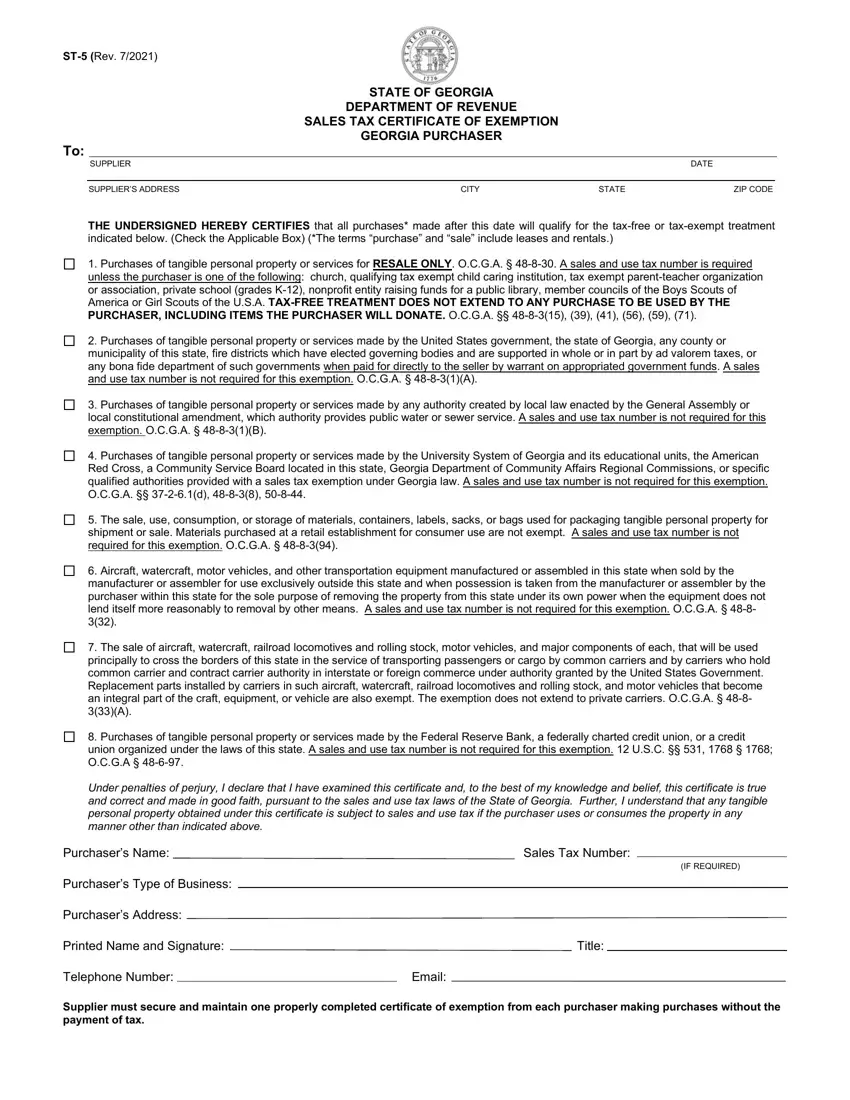

Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15 Taxation of Public Utilities Page 16. Apply for a Homestead Exemption Georgiagov. Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property.

Title Ad Valorem Tax - Motor vehicles purchased on or after March 1 2013 and titled in this State are exempt from sales and use tax and annual ad valorem tax. 2016 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-41. You must meet the requirements of Georgia Law for exemption under code section 48-5-41.

Qualifying disabled veterans may be granted an exemption of 60000 plus an additional sum from paying property taxes for county municipal and school purposes. The additional sum is. Property taxes are the cornerstone of local neighborhood budgets.

To apply for a. A homestead exemption can give you tax breaks on what you pay in property taxes. Property 5 days ago Apply for a Homestead ExemptionA homestead exemption can give you tax breaks on what you pay in property taxes.

A homestead exemption reduces the amount of property taxes. Tax exempt status of a property is not transferable by a change in ownership between two entities. Any Georgia resident can be granted a 2000 exemption from county and school taxes.

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. All tools and implements of. It applies to the value of.

Georgia exempts a property owner from paying property tax on.

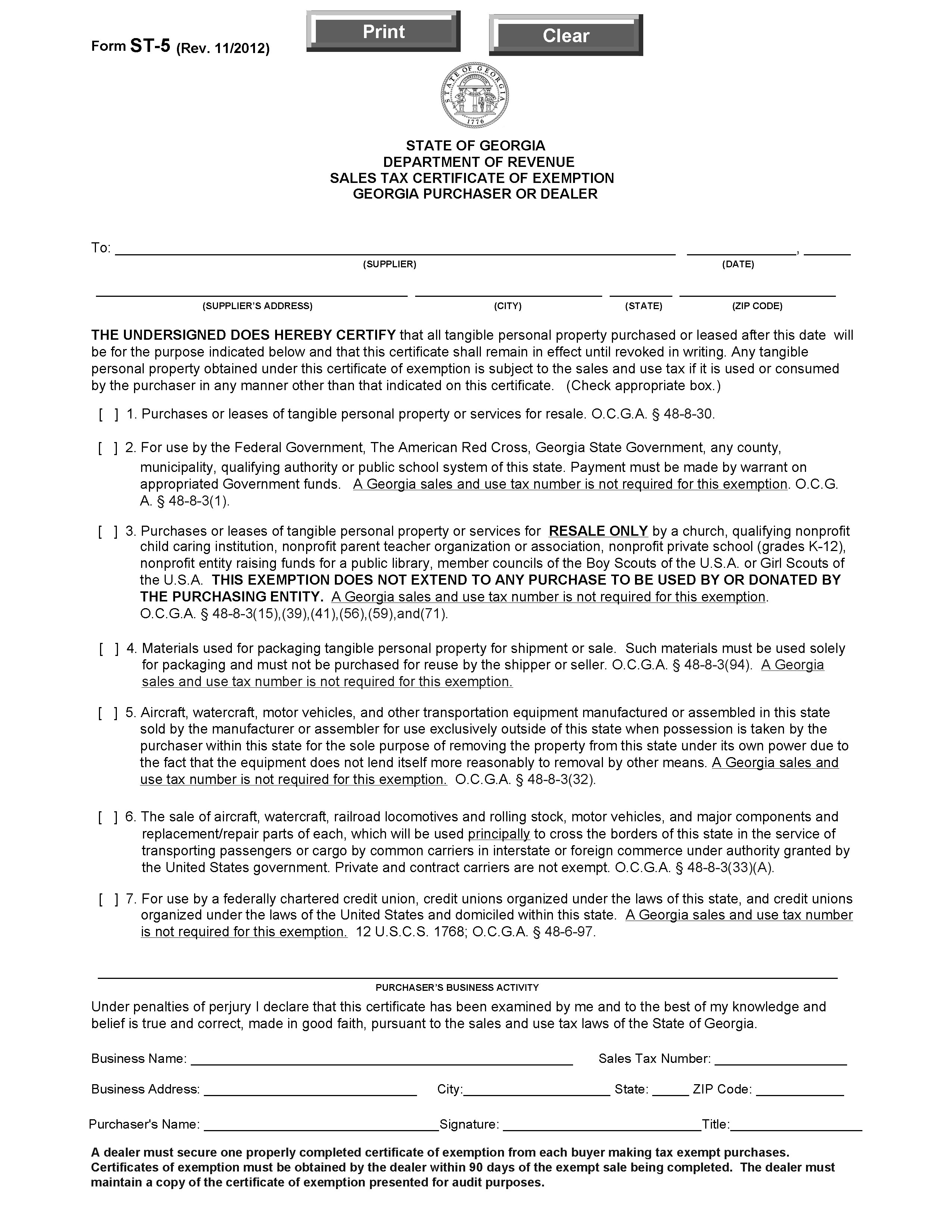

Georgia Resale Certificate Trivantage

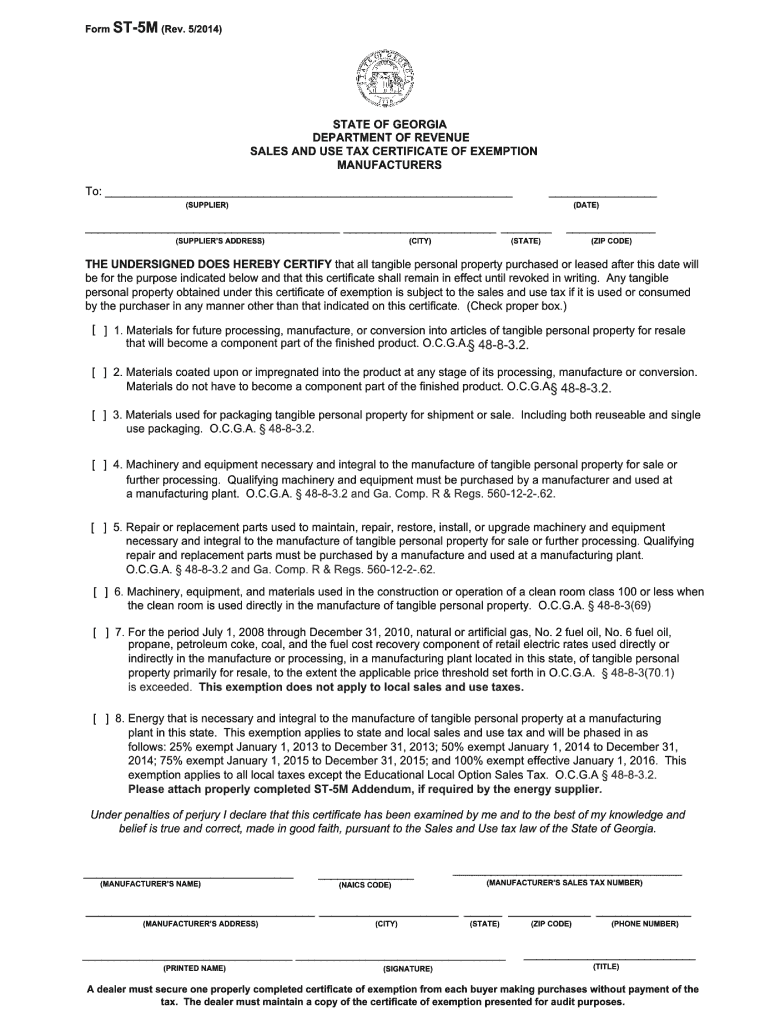

Form St 5m Georgia Fill Out Sign Online Dochub

Homestead Exemption Codes Qpublic

Georgia Form St 5 Fill Out Printable Pdf Forms Online

2007 Sutherland Asbill Brennan Llp Introduction To Georgia Property Tax For Non Profits Charlie Kearns Sutherland Asbill Ppt Download

What Is A Homestead Exemption California Property Taxes

Gsccca Org Pt 61 E Filing Help

Exemptions Henry County Tax Collector Ga

April 1 Is The Homestead Exemption Application Deadline For Fulton County Homeowners

About Homestead Exemptions Effingham County Ga

Dekalb County Ga Homestead Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Gsccca Org Pt 61 E Filing Help

Homestead Exemption Codes Qpublic

Gsccca Org Pt 61 E Filing Help

Exemptions To Property Taxes Pickens County Georgia Government